south dakota vehicle sales tax rate

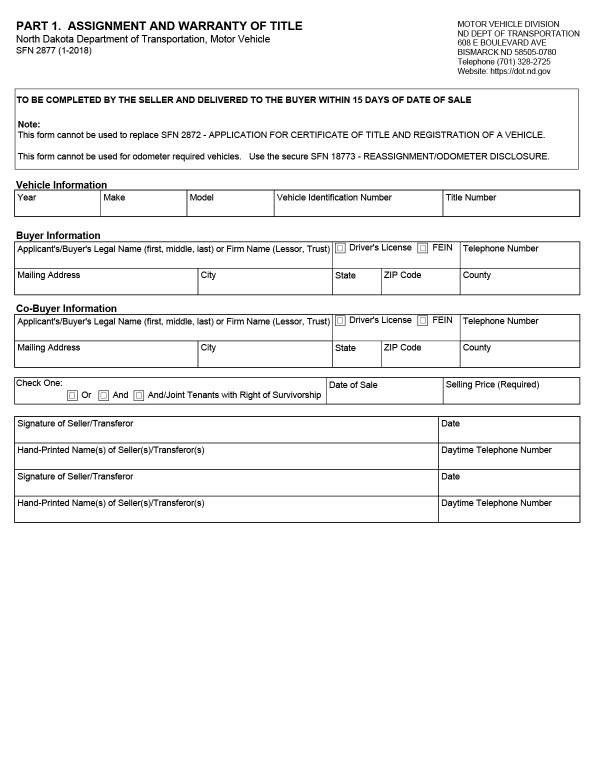

That is the amount you will need to pay in sales tax on your. One field heading labeled Address2 used for additional address information.

South Dakota Income Tax Calculator Smartasset

All car sales in South Dakota are subject to the 4 statewide sales tax.

. Average Sales Tax With Local. The state sales tax rate in South Dakota is 4500. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

Rate search goes back to 2005. With local taxes the total sales tax rate is between 4500 and 7500. Maximum Local Sales Tax.

They may also impose a 1 municipal gross. Different areas have varying additional sales taxes as well. To calculate the sales tax on a car in South Dakota use this easy formula.

South Dakotas sales and use tax rate is 45 percent. The highest sales tax is in Roslyn with a. South Dakota has recent rate changes Thu Jul 01.

- All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under. The South Dakota Department of Revenue administers these taxes. Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65.

South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles. Exact tax amount may vary for different items. South Dakota has a 45 statewide sales tax rate.

But that is not all as there are other payments you have to make as well. Print a sellers permit. Owning a car can be rather expensive from the point of buying it.

The base state sales tax rate in South Dakota is 45. Average Local State Sales Tax. South dakota has a 45 statewide sales tax rate but also has 289 local tax jurisdictions including cities towns counties and special districts that collect an average.

Report the sale of a vehicle. First multiply the price of the car by 4. Mobile Manufactured homes are subject to the 4 initial.

2022 List of South Dakota Local Sales Tax Rates. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. 4 State Sales Tax and Use Tax Applies to all sales or purchases of taxable.

One field heading that incorporates the term Date. Municipalities may impose a general municipal sales tax rate of up to 2. South Dakota Vehicle Excise Tax Explained.

South Dakota State Sales Tax. Motor Vehicle Sales and Purchases South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

2022 South Dakota state sales tax. Will be granted reciprocity when you come to South Dakota and will not have to pay. Find your South Dakota.

4 State Sales Tax and Use Tax Applies to. The state also has several special taxes and local jurisdiction taxes at the city and county levels including lodging taxes alcohol taxes. Maximum Possible Sales Tax.

Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax. The vehicle is exempt from motor vehicle excise tax under. Find out the estimated renewal cost of your vehicles.

Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax.

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A Resident

_(1).jpg)

Deduct The Sales Tax Paid On A New Car Turbotax Tax Tips Videos

How Do State And Local Sales Taxes Work Tax Policy Center

How To File And Pay Sales Tax In South Dakota Taxvalet

Car Tax By State Usa Manual Car Sales Tax Calculator

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Why Do So Many Rvs Have Montana And South Dakota License Plates Outdoorsy Com

North Dakota Sales Tax Rates By City County 2022

Vehicle Registration Cost Calculator South Dakota

Government Faqs South Dakota Department Of Revenue

Sales Use Tax South Dakota Department Of Revenue

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Are There Any States With No Property Tax In 2022 Free Investor Guide

South Dakota Sales Tax Rate Rates Calculator Avalara

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

How South Dakota Became A Haven For Both Billionaires And Full Time Rv Ers Marketwatch

States With No Income Tax Explained Dakotapost